- #Biweekly mortgage calculator with extra payment option for free

- #Biweekly mortgage calculator with extra payment option free

Amazing.Īdditionally, it’s easy to execute. So you pay less interest in a shorter amount of time. This reduces the total amount of interest due throughout the life of the loan. First, you don’t pay any extra junk fees to have someone do it for you.Īnd second, because you make an extra payment to principal each month, your loan balance is reduced each month and home equity is accrued faster.

#Biweekly mortgage calculator with extra payment option free

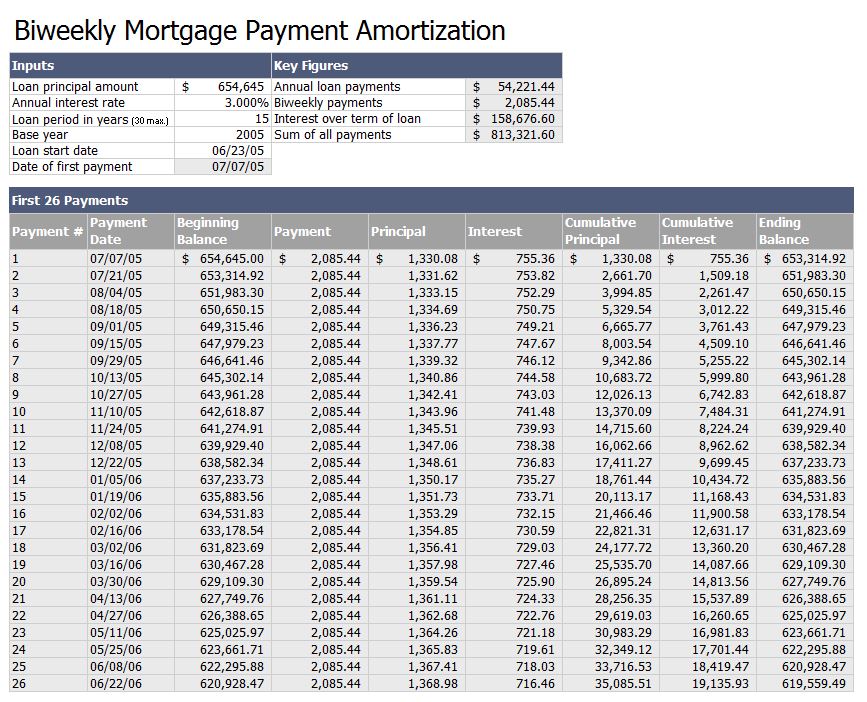

This free biweekly mortgage method actually works in your favor for several reasons. It’s important that this is 100% clear so the money goes to the right place. If you don’t make this clear, some lenders will return the surplus money, apply it to your next payment, or perhaps apply it your escrow account. Mortgage term: 309 months (loan paid off more than 4 years early)īe sure that you note the extra amount is to go toward the principal balance! New combined payment (paid just once a month): $1,065.87 Regular monthly mortgage payment: $983.88 Let’s look at an example of a do-it-yourself biweekly mortgage: They should accept the higher payment and put any additional funds toward the outstanding principal balance automatically.Īnd that will allow you to pay off your mortgage ahead of schedule. Then send in your increased monthly payment to the bank or lender. Simply take your normal monthly mortgage payment, divide it by twelve, and add that amount to your mortgage payment each month. Instead of having a biweekly mortgage company handle your monthly payment for a fee, or having to make 26 payments a year.

Simply add 1/12th of your regular payment to your total mortgage payment.

#Biweekly mortgage calculator with extra payment option for free

You can do biweekly mortgage payments for free too.So you’ve thought about it and like the benefits a biweekly mortgage affords, but it seems somewhat defeatist to pay someone to help you save money on your mortgage right? Right.įortunately, there’s an alternative to do it yourself with a “no cost biweekly mortgage” plan, thereby avoiding those payment processing companies completely. – you might be able to put your money to use elsewhere if you have a low mortgage rate – you might be better off making a lump sum payment early in the year instead – there may be fees associated with a biweekly mortgage program – not everyone actually wants to pay down their mortgage faster (or at all) – that money is now locked up in your property – you put more of your hard-earned money toward the mortgage each month (and year) – more frequent payments decrease the outstanding principal loan balance faster And the drawbacks… – your mortgage payments are automated and made simple – you can reduce the term of your mortgage and own your home sooner

– you can save money by paying less interest on your mortgage – you can increase the amount of equity in your home at a faster rate

So what are the benefits of a biweekly mortgage anyway? No sense is paying for a service you can get free of charge. Your bank or loan servicer (whoever handles your mortgage) will likely ask you to set-up a biweekly payment system with an intermediary, which acts as a liaison between you and your lender.īut these biweekly payment companies can get expensive, especially when they charge a set-up fee of anywhere from $200-$500 and then an additional fee for each transaction.Īnd at that point, it would start to defeat the intended purpose of saving money!įortunately, some banks and credit unions may offer the service in-house for free so you don’t have to worry about the fees.Īlways inquire with your loan servicer first before seeking out an outside company. Instead, you may need to enroll in a biweekly mortgage payment program of some kind. You can’t expect the bank or mortgage lender to allow you to mail in a half payment twice a month, that simply won’t fly. This can be especially useful if mortgage rates are high, but less so if you’ve got a rock-bottom rate that isn’t costing you much money. Put simply, you’ll pay the bank less interest and own your home sooner, if that’s your goal. That extra $2,000 equates to one payment – and because it is allocated throughout the year, it pays down your mortgage balance earlier than scheduled, which saves you interest and builds home equity sooner. Instead of paying a total of $24,000 throughout the year, you’d wind up paying $26,000. Let’s pretend you’ve got a 30-year fixed mortgage if your monthly payment were $2,000 per month, under one of these payment plans you’d pay $1,000 every two weeks.

0 kommentar(er)

0 kommentar(er)